It’s not often a Lady Gaga song is quoted at the top of an academic research paper on financial economics. In fact, it might be a first.

However, the hitmaker’s song “Born This Way” underscores Colorado State University Professor Harry Turtle’s co-authored paper involving genetics and participation in the stock market.

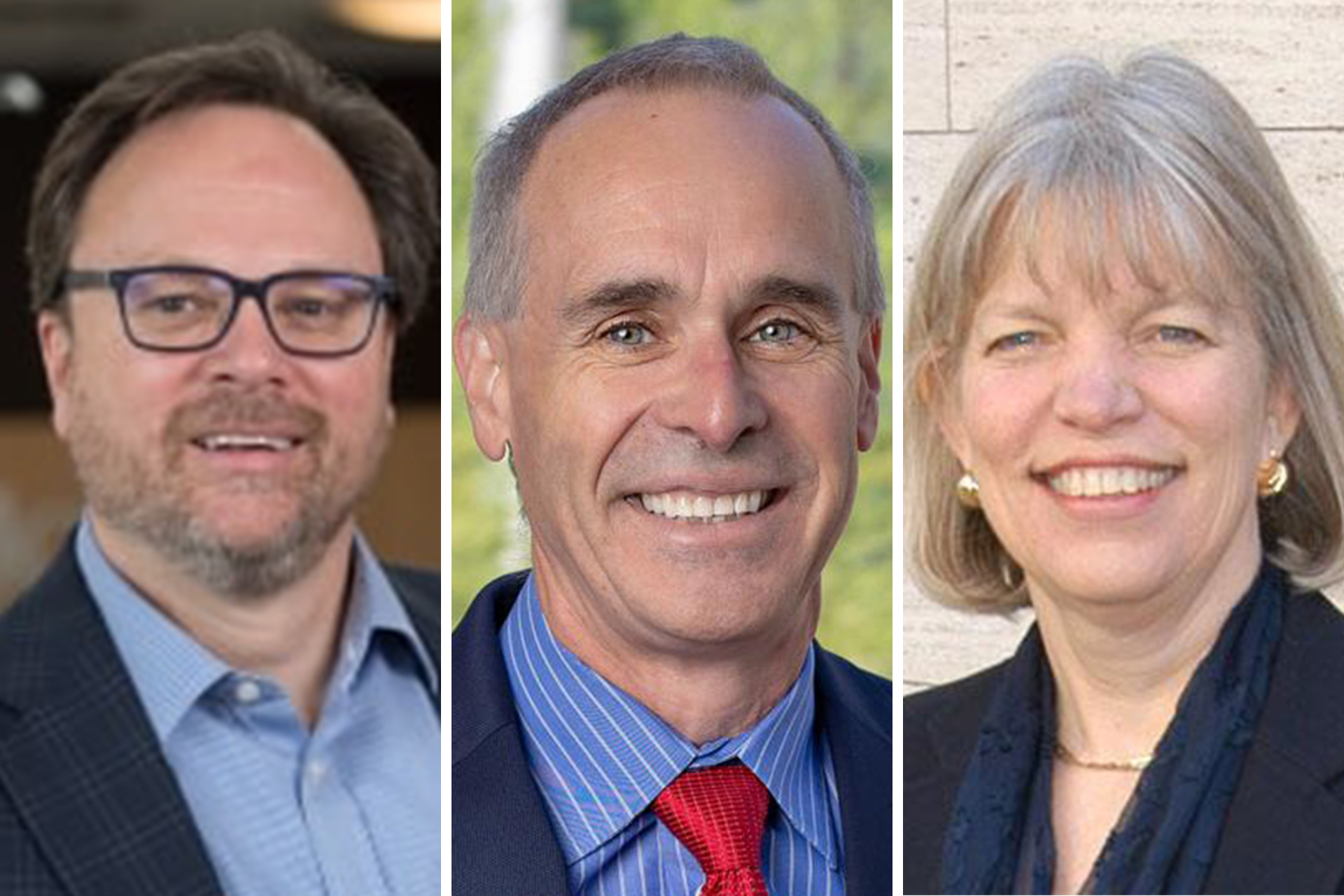

Turtle, a professor of finance at CSU’s College of Business, has teamed up with finance professors Richard Sias at the University of Arizona and Laura Starks at the University of Texas at Austin to produce an award-winning working paper that suggests genetic traits to some degree can predict an individual’s participation in the stock market.

In the past three years, the researchers have been using advances in molecular genetics to understand how DNA variation across individuals can influence financial choices.

Their paper, “Molecular Genetics, Risk Aversion, Return Perceptions, and Stock Market Participation,” suggests that genetic traits — such as cognition, personality, health and body shape — can help predict an individual’s participation in the stock market. For their work, the researchers were awarded the Jack Treynor Prize, an honor recognizing outstanding working papers in the fields of investment management and financial markets.

“We consider how return beliefs impact financial decisions,” Turtle said. “We find that people often have large errors in their beliefs relative to historical market returns in a manner that varies with genetic propensities.”

The researchers say in their paper that stock market participation is positively related to genetic traits associated with educational attainment, general cognition and height; and inversely related to genetic traits associated with neuroticism, depressive symptoms, myocardial infarction, coronary disease and high body mass index.

Turtle explained that these types of genetic underpinnings may account for as much as 30% of explained variation in stock market participation. While modest, he said it’s significant.

“Let’s say you have a genetic propensity determined at conception that leads you to trust financial markets less, to be more risk averse, and to underestimate the return you are likely to receive,” he said. “Then, you’re less likely to participate in the stock market. All of these statements tend to be true for individuals with predispositions toward neuroticism or depressive symptoms, for example.”

Cracking the stock market participation puzzle

According to Gallup, almost half of Americans have no money invested in the stock market, and stock market participation appears to be declining – falling from 62% in early 2000s to about 55% today. Given the historically high return of equity markets in the long-term, Turtle referred to this as the stock market participation puzzle.

“I see what we’re doing as important from a social welfare perspective,” he said. “We have massive wealth inequality, and we have a lot of people who don’t participate in the stock market. We don’t have a good economic rationale to describe this behavior. It’s not just that people can’t afford to invest.”

Turtle believes that stock market under-participation is not likely to be eliminated with more financial education, especially if people have a genetic propensity not to participate, or if they have other psychological biases that cause under-participation.

For their research, the team pulled data from the Health and Retirement Study, a longitudinal study supported by the National Institute on Aging and the Social Security Administration that surveys more than 26,000 Americans over the age of 50 every two years.

Using financial, psychosocial, demographic and genetic data from the survey, they focused on eight traits as mapped by Genome Wide Association Studies: cognition (educational attainment and general cognition), personality (neuroticism and depressive symptoms), health (myocardial infarctions and coronary artery disease) and body type (height and BMI).

Examining other areas

Turtle explained the team’s interest in connecting the dots between business, psychology and genetics started three years ago when they started thinking about household finance. Examining the Health and Retirement Study data, biology measures — in particular genetic risk scores — grabbed their attention.

“We started wondering how much this stuff matters,” Turtle said. “The more we looked at it, the more we realized it really impacts decisions.”

In another paper currently in progress, the team is examining how negativity bias can impact financial decisions. They show that people who are fearful of dying from the swine flu also are those who are most likely to display erroneously negative expected return beliefs. These people also are less likely to invest in stocks. While this study does not include genetic data, they find a significant negativity bias in respondent beliefs.

“We find that some people are much more sensitive to a loss than others,” Turtle said. “They don’t deal with losses as our economic models suggest; and not surprisingly, they don’t take part in the stock market if they incorrectly underestimate expected returns.”

Moving forward, Turtle said they’re working on getting the stock market participation paper published, adding that it has been received well by the research community. Other areas of exploration down the road might include epigenetics, the study of how behaviors and environment can influence changes in how genes work.

“The further I get into this field, the more excited I am about additional studies,” he said.