Immpower Brings Alternative Finance Options to Immigrants

Immpower is going to help immigrants and refugees achieve the American dream of business ownership – even if that means rebuilding financial institutions to do it.

“There’s so many predatory lenders taking advantage of people,” MBA candidate Marya Skotte said. “The debt financing model we have in Western countries puts people at such a huge disadvantage from the get-go. People are already struggling, trying to build a business.”

Eliminating the lender-borrower relationship may sound like a radical approach to reforming banking, but the venture’s members are anything but outsiders in the finance and social welfare worlds. Developed over the summer experiential learning portion of the Impact MBA’s Social Entrepreneurship track, Immpower is introducing the models of Islamic financing becoming more popular in Europe to American financial institutions – and making inroads with lenders that are curious about the system.

Islamic financing is an alternative financial system that is based on Shariah principles and prohibits the payment and collection of interest. Financial institutions have embraced it as a model that upends the existing models of interest-generating loans in favor of profit-sharing arrangements in which lenders and borrowers are partners and share the profits as well as risks until the loan is repaid. Advocates of the financing model argue that it keeps financiers more invested in their community, and creates neighborhoods where banks, their customers and local businesses all have a financial stake in helping borrowers’ businesses succeed. These models open the door to financing to members of religions with beliefs that oppose interest-bearing loans, such as the 3.45 million Muslims living in the United States.

“This system believes interest is unfair, particularly for the borrowers if their business doesn’t perform well,” Immpower’s Manezha Sukhanyar said, “but if it is based on a profit and loss sharing mechanism – equity financing – their burden will be much lesser.”

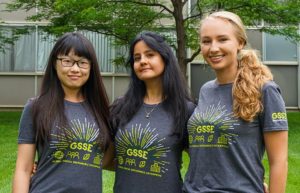

Immpower leveraged its three members’ personal and professional experience as it performed market research and product development over the summer. Sukhanyar served as chief of Islamic banking and vice-chair of the Afghanistan Banking Association. Skotte previously worked with immigrant communities in Oakland. Beth Hsu brings the perspective of an international student. Using these backgrounds, the trio worked as consultants for a Community Enterprise Development Services (CEDS), a community development financial institution in Aurora, Colo., to develop a Sharia-compliant line of credit known as running Musharakah (running partnership) . If the bank implements the product, it will be the first to offer that form of Sharia-compliant line of credit in the United States.

The introduction of new financial instruments isn’t merely pioneering. It opens financing options to communities who typically don’t access to traditional financing, be it because of spiritual beliefs or because the barriers to entry into standard business financing are too high for immigrants.

While a single bank’s consideration of expanding into Islamic finance is a small win, Immpower hopes it’s a harbinger of things to come. The venture is developing a consulting company as its members complete their MBA. The outlook for the company has been rosy for the trio, which discovered that banks expressed a considerable amount of interest in developing Sharia-compliant financial instruments of their own.

“We were kind of really pleasantly surprised at how much interest there was around Islamic finance,” Skotte said. “A lot of organizations don’t currently offer it, but they were really interested.”

Developing a venture in the midst of a worldwide pandemic is, in most cases, less than ideal. Immpower’s members were forced to develop alternate plans, staying close to home to collaborate with industry professionals instead of performing research across the country. It also presented an unseen opportunity, as the rapid contraction of an economy hunkering down to quarantine – and the turmoil it created in nearly every industry – illuminated the weaknesses in traditional lender-borrower relationships.

Developing a venture in the midst of a worldwide pandemic is, in most cases, less than ideal. Immpower’s members were forced to develop alternate plans, staying close to home to collaborate with industry professionals instead of performing research across the country. It also presented an unseen opportunity, as the rapid contraction of an economy hunkering down to quarantine – and the turmoil it created in nearly every industry – illuminated the weaknesses in traditional lender-borrower relationships.

“It’s more relevant than ever to the kind of situation we’re in right now,” Skotte said. “It’s pretty evident that businesses are not doing well. You know our current banking systems, at least in the U.S., are pretty broken.”

Spinning up a consulting company will have to wait for a few more months, as the team members bring their venture back to campus to complete the final semester of the Impact MBA program. Now that the summer practicum is behind them, Immpower’s members bring the lessons they learned from the experiential portion of their back to the classroom.

“I want to get my hands dirty, roll up my sleeves. You know, be able to actually apply what we’re doing,” Skotte said. “And so, the summer practicum and the whole model of the Impact MBA was really compelling to me.”

Immpower is just one of the ventures in the Impact MBA that is finding new ways to use business to build a better world.

Read more learn more about sustainable yak wool, greenhouse-gas busting livestock feed and more.