Will Keivit spent many of his Saturdays this winter doing something many Americans dread: filing tax returns. The College of Business student wouldn’t have had it any other way.

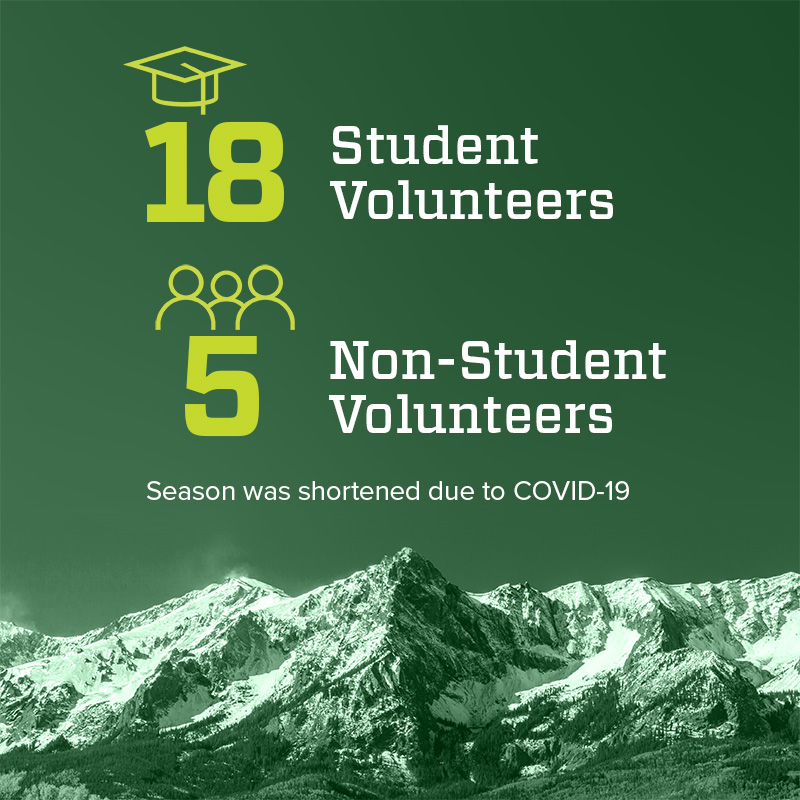

For the second year of his college career, the senior accounting major traded critical study time and prime ski weekends to help strangers with their income taxes as a volunteer for the AARP Tax-Aide program. Senior accounting major Keivit was one of 18 students who volunteered or received course credit for helping fellow taxpayers as the program returned to the College of Business for the fifth year. The free tax-preparation service relied exclusively on student and community volunteers to staff it each Saturday starting Feb. 8.

“Initially, it’s hard to justify giving your Saturdays away to do taxes, but by the second week it’s a blast,” he explains. “I had such a great time doing it last year that I had to come back.”

Considering the program’s results, it’s easy to see from where Keivit’s enthusiasm stems. Public-health concerns shortened its season, but its volunteers still processed 100 returns and helped taxpayers claim $146,358 in refunds in its truncated five-week schedule. The program also aided taxpayers to secure more than $54 thousand in earned income, child and education credits that might have slipped through the cracks if prepared by someone unfamiliar with the tax code.

Building that familiarity with tax strategies requires more than a casual commitment to AARP Tax-Aide’s cause. Many volunteers have served for more than a decade as volunteer tax preparation aides or have professional experience in tax accounting. Reilly’s student volunteers apply the foundations in accounting they honed at their time in the College of Business. Students participating in the program for credit as part of an accounting independent study were required to complete training provided by the IRS to achieve Volunteer Income Tax Assistance/Tax Counseling for the Elderly certifications.

Those credentials ready Reilly’s preparers to tackle a wide range of filing needs. Although the College’s volunteers team with AARP, which typically targets low-income senior citizens, the College’s free preparation services are open to anyone who isn’t self-employed, post a loss or have a Schedule C for their business. Each year, volunteers lend their skills to a wide range of populations: seniors, CSU staff and faculty and, of course, students.

“We will prepare taxes for anybody,” Kristen Reilly, accounting instructor and faculty organizer of the event said. “So, if you’re student there, we would do your taxes for you.”

Soft Skills and Hard Times

There’s a lot more than knowing how to apply IRS guidelines or correctly complete a Form 1040 required to serve AARP Tax-Aide’s clients. Collaborating on a tax return requires a taxpayer to lay bare their finances to a stranger, to expose the good decisions and bad habits alike. With taxpayers in such an inherently vulnerable situation, student volunteers quickly learn that there’s a distinctly human element to tax accounting that may not be presented in their coursework.

The opportunity to learn those soft skills was one of the reasons original faculty organizer Bill Mister brought the program onto campus in 2015. Now a professor emeritus of accounting who continues to serve as a volunteer tax preparer, Mister’s seen students blossom as real-life experiences help them develop the personal skills necessary to serve the program’s clientele.

“Students have to sit there and interview and realize that the information is confidential. They realize they have to build trust,” he said.

As the only free tax preparation service open on Saturdays in Fort Collins, campus AARP Tax-Aide offered access to services that may be otherwise unattainable for taxpayers with work commitments during the week. Many of these taxpayers were low-income filers, on disability or public support – all tax situations that aren’t typically represented in personal tax-filing services.

While the economic challenges some of AARP Tax Aide’s taxpayers faced presented student volunteers with relatively novel filing statuses, they also helped open students’ eyes to a side of tax policy to which many CSU students aren’t exposed.

“It gives the students the opportunity to understand there’s another side of the world,” Mister said. “Most of our students don’t come across people who have to raise three children on $10,000 of income. That’s not something they see.”

Mike Warner, a community volunteer with the program agrees. “Most of the kids working in corporate accounting will never see a taxpayer who only makes $30,000 a year,” he said. “This is important for them to understand.”

Rams Give Back

While student volunteers benefit from the hands-on experience they receive in the program, it’s not a drive to expand skill sets, develop interpersonal skills or even network with volunteer professionals that drives involvement in AARP Tax-Aide. They share a motivation with volunteers: a desire to help others with their taxes.

Some volunteers view paying taxes as a responsibility of citizenship and want to facilitate the process for their fellow Americans. Others see it as a way to reduce the stress and anxiety that may come with submitting returns when taxpayers are unsure they claimed all the credits and deductions to which they are entitled. Still others understand that navigating a 1040 can be difficult and think assistance on a fundamental requirement of citizenship shouldn’t be a matter of privilege. Irrespective of personal motivations, AARP Tax-Aide volunteers are doing something familiar to most BizRams: Using their business skills to make the world a better place.

“Giving up their Saturdays to prepare taxes tells me that students are motivated to help others within their community,” faculty coordinator Reilly said. “I always ask of my students to be ‘all in, all the time,’ and there is no place where this shines brighter than when we meet to prepare taxes each Saturday through tax season.”