First things first: The Ever Given is a big boat. Technically, an Ultra Large Container Vessel, the largest classification of cargo ship.

So, when the Ever Given ran aground in the middle of the Suez Canal and halted ship traffic through the passage it was an ultra-large problem. The vessel’s meme-worthy saga came to a welcome conclusion when it was freed after six days. However, the shipping delays and ripple effects caused by blocking one of the world’s most vital trading routes for nearly a week highlighted something the global supply chain has been dealing with for over a year: how to handle lots – and lots – of disruption.

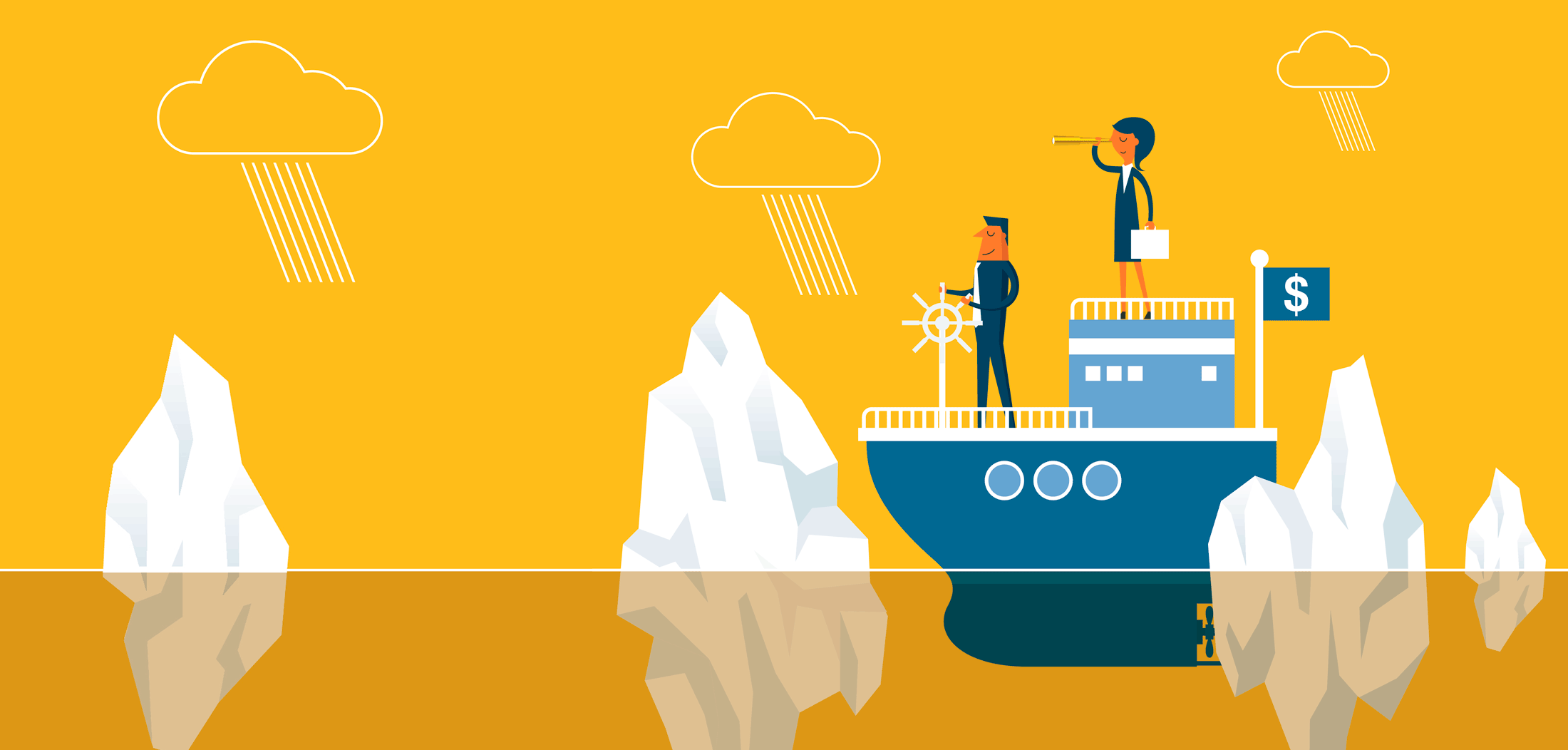

Similar to navigating a 200,000-ton ship stacked with more than 18,000 containers through a 120-mile canal during a dust storm, our global supply chain is stretched to its capacity during strenuous times, leaving little room for error.

Even before this year’s pandemic-induced 30 percent spike in e-commerce sales, there were high demands not only on ocean shipping, but also the trucking industry, railways, air freight and even warehouses.

“Most of the different modes of transport are pretty close to 100 percent capacity,” said Susan Golicic, Ph.D., chair of the CSU College of Business’s management department and a professor of supply chain management. “It’s like a very crude ballet. It’s orchestrated so that when everything’s normal things move very well, and then when you throw a disruption into the mix, then it doesn’t move very well.”

The Lay of the Land – and Seas

Ocean shipping, which carries more than 90 percent of the world’s traded goods, serves a key role in supply chains by offering an effective and efficient way to move things great distances. In response to high demand, companies have invested in more ships, and in two decades doubled the carrying capacity of the world’s fleet. In 2020, an estimated 1.5 tons of goods were transported for each of the world’s nearly 8 billion residents. Much of this increase in capacity has been accomplished by boosting the size of container ships with the goal of capitalizing on economies of scale.

“Then what happens is those ships are very limited as to where they can go because only so many ports will accommodate those huge ships,” Golicic said. “So there are limitations just due to the natural infrastructure and you can’t necessarily say ‘Well, just put more ships out there,’ because you’ll have congestion in the ports.”

The Suez Canal began an $8.2 billion expansion project six years ago to allow for more traffic and larger vessels. As made apparent by the Ever Given’s grounding, the route still has challenges.

As ships grow wider the margin for error grows smaller. In canals, complicated hydrodynamic forces like the bank effect can come into play when the space between ships and the edge of a waterway narrows, causing changes in water pressure to pull vessels toward embankments.

“The Suez Canal is one of the biggest canals, so it can handle these super ships, but there’s very little clearance and it requires really great piloting and good conditions,” Golicic said. “These ships have to go directly in the middle and they have to be perfectly straight to make it through the canal, and at 120 miles, it’s not a short canal.”

With regular industry concerns about driver shortages, what’s stopping folks from signing up to hit the open road for a living?

“The bottom line is it’s not that attractive of a lifestyle for someone to never be home,” Golicic said.

This challenge, along with an aging workforce, difficulties recruiting new drivers, and many other factors, make maintaining a stable and flexible workforce challenging. Further compounding the matter, unpredictable pay, as researched by College of Business associate professor of management Samantha Conroy, presents another obstacle.

April 2020 also brought the biggest one-month trucking job loss ever recorded when more than 88,000 people lost their jobs after freight volumes initially spiked due to panic buying and then crashed. And although those jobs have begun coming back, they still haven’t caught up to pre-pandemic levels.

“They’re running as many trains as they can on the track as it is, and they just can’t add more trains,” Golicic said.

The same fluctuating shipping volume challenges felt across global supply chains have impacted the freight rail network as well, with major companies like Union Pacific using steep surcharges to try and restrict volume.

So, what does it all mean?

Supply chain managers and logistics companies are no strangers to disruption.

“Those disruptions can be as simple as, ‘My supplier just didn’t get the stuff loaded in time for the actual transport to occur today. So, I’m going to get it a day late.'”, said Golicic. “All the way up to something major like the blockage in the Suez Canal or a natural disaster that takes out a factory.”

However, what is new is the lengths companies are going to to prepare for – and manage – those disruptions.

Assessing disruption starts with companies asking one simple question: Is this a permanent change or a temporary one?

“If it’s a temporary change then what they try to do is keep up as best as they can, serve their important customers first, and then filter that through the supply chain,” Golicic said.

Many of the changes brought on by the pandemic are temporary, like personal protective equipment (PPE) shortages and consumers stocking up on toilet paper and dried food.

However, with permanent changes, the calculus shifts.

“So, in that case, supply chain managers will say, ‘Alright, what kind of permanent changes, do we need to make?’” Golicic said.

That could range from adding new suppliers to sourcing more goods locally and even building up risk-management teams to better keep tabs on complex and interconnected global events.

“Many companies are actually hiring several people whose job it is to watch that [risk level], manage it, divert freight, move things around,” Golicic said. “There are some companies, particularly larger ones, that will literally have command centers where they’re monitoring what’s happening in different countries. Are there political issues? Are there weather issues? Are there other risks that could affect freight travel.”

For instance, FedEx has a team of 15 meteorologists who work around the clock providing in-depth weather analysis and multiple forecasts each day. Their work supports other logistics teams who use that information to reroute the company’s global fleet of trucks and planes.

What’s next?

Although it’s impossible to predict exactly what the future will hold for supply chains, one thing is clear: The ability to deftly navigate disruption will be a key factor in staying ahead of the curve.